As a thriving insurance representative, you possess a robust mechanism for monitoring your insured clients that suits your needs, even if it has been quite some time since you last updated it. Then what could make you consider something different from your routine? Simply put, it can make your life considerably more convenient.

Perhaps you’re still utilizing paper documents or Excel files to handle your clientele. This might be an indication that it’s high time to contemplate a Customer Relationship Management (CRM) framework. Essentially, a CRM is an application designed to assist in managing your customers, quotations, insurance policies, and other relevant information.

Superior CRM solutions for insurance representatives not only offer the fundamental features but also provide tools that enable business expansion, such as automation of marketing and follow-up emails.

Several CRM systems that exist today follow a Software as a Service (SaaS) model. These SaaS offerings make the onboarding process simple, allowing you to start adding clients right away, with the typical billing model being subscription-based.

Stay with us to uncover the leading CRM applications for insurance agents and to learn how to select the one that best fits your needs.

The Necessity of CRM Software for Insurance Agents

Every single day, insurance agents must handle a multitude of tasks. If your operations are not streamlined and your time is not managed efficiently, the sheer volume of work can become daunting.

Under the most adverse conditions, you might overlook critical tasks, thereby risking the loss of insured clients. Even in a more favorable scenario, you might find yourself overburdened and stressed, which is far from ideal.

CRM software for insurance aids agents and brokers by organizing their leads, insured clients, and tasks, thus enhancing overall effectiveness.

Specifically, your CRM will support improvements in task management, follow-up emails, and marketing endeavors.

Увеличьте свой азарт с gamma casino, где вас ждут захватывающие игры и выгодные бонусы.

The CRM Features Tailored for the Insurance Sector

Initially, CRM software was developed as a sales tool. Even though insurance agents do sell products, there are several critical tasks unique to the insurance sector.

The optimal CRM application for insurance agents should cater to the distinct business requirements of the insurance industry.

When in search of a customer management solution, you should opt for a provider that includes features like:

- Commission tracking capability

- Automation of sales processes and workflows

- Claims management

- Management of policy information

- Email marketing templates and automation

- Management of insurance applications and quotes

The above-listed industry-specific CRM features can significantly bolster your overall productivity.

Leading CRM Software Platforms for Insurance Agents:

When it comes to choosing a CRM for your insurance enterprise, you have a few diverse options. There are insurance agency management software companies that also offer CRM solutions (such as Radiusbob or AgencyBloc).

Alternatively, you can consider sales CRM software systems that come with specialized insurance management tools (such as Zoho or Freshworks).

In the following, we present eight of the finest CRM solutions for insurance agents aimed at simplifying their sales procedures and enhancing the customer experience.

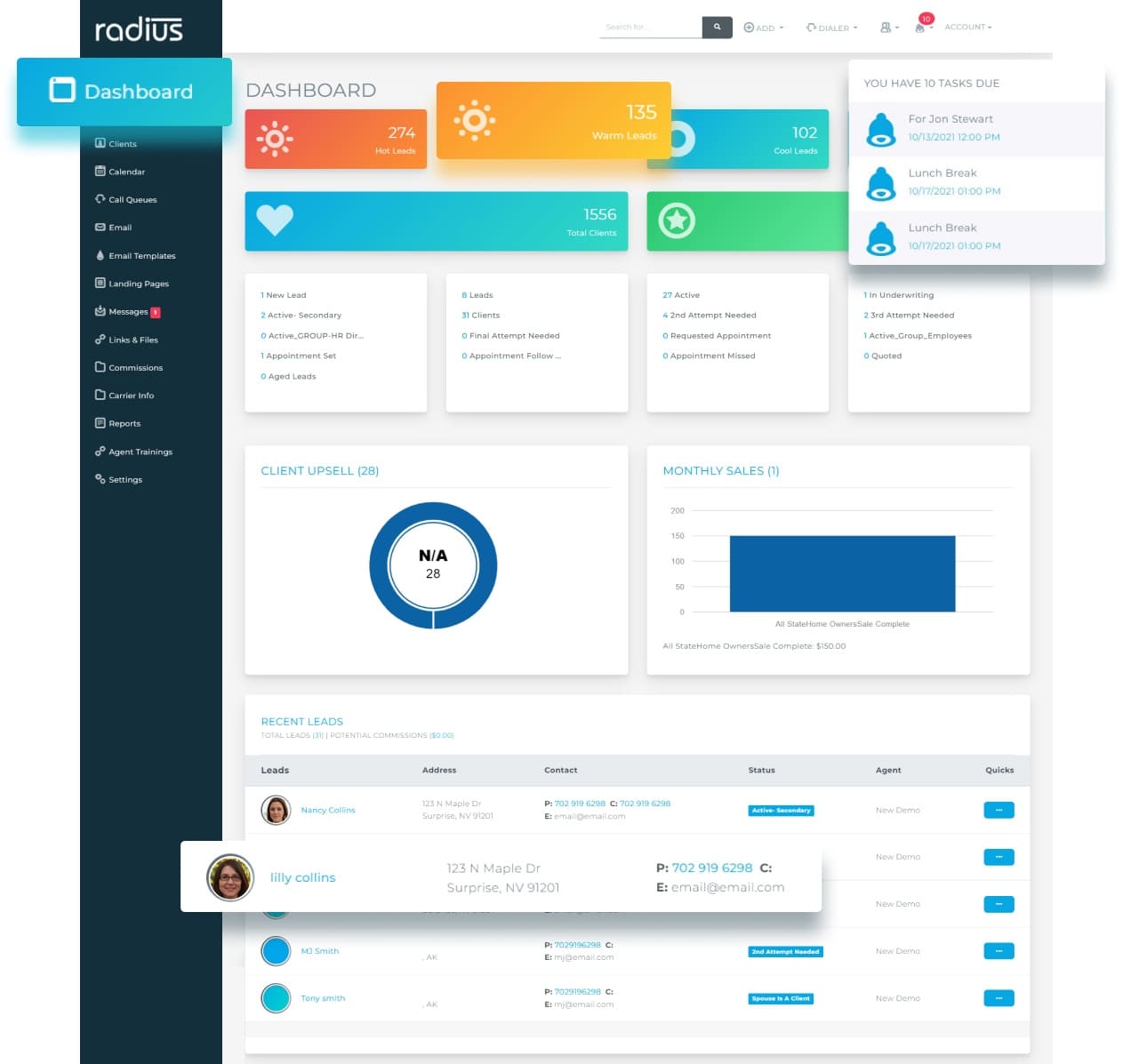

1. Radiusbob

Radiusbob provides a CRM platform and lead management system specifically designed for insurance brokers. Interestingly, the “bob” in its title is an acronym for “book of business.”

Notably popular in the insurance sector, Radiusbob is utilized extensively by agents and large-scale firms to facilitate their interaction with policyholders. This CRM system, offering a high degree of customization, even extends the provision for acquiring phone services for call centers.

Here are some prominent features of Radiusbob:

- Comprehensive contact management

- Capability for screen sharing, phone calls, and text messaging

- Automated distribution of leads

- Quotation tools

- Email marketing and automatic response systems

It’s the optimal CRM choice for: Insurance agents seeking a combined CRM and VoIP solution.

Pricing: Packages begin at $34/month. Additionally, Radiusbob offers a 14-day trial at no charge.

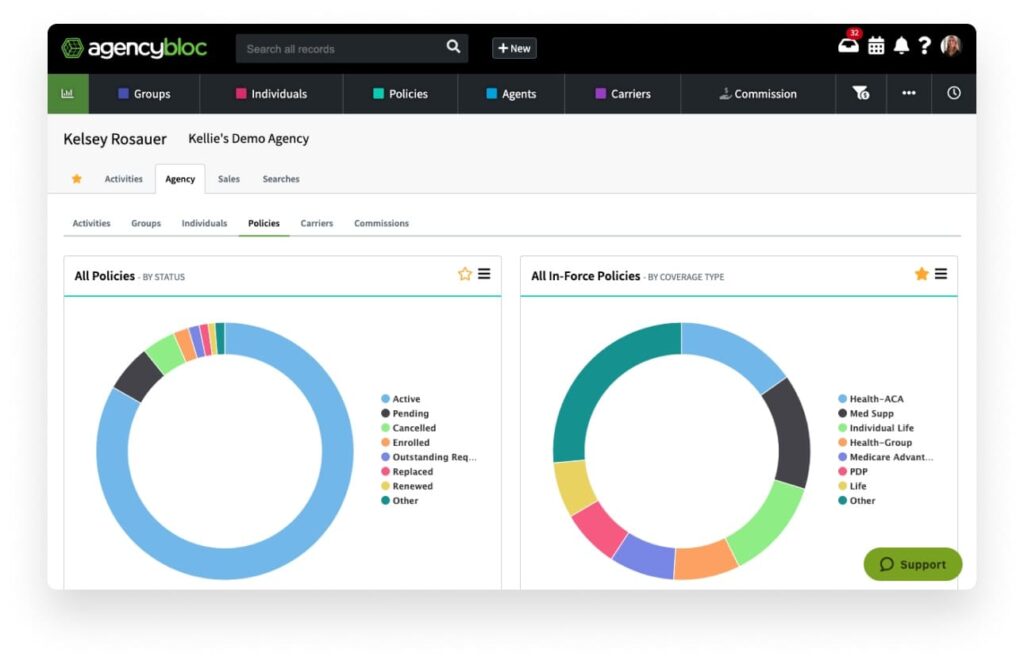

2. AgencyBloc

AgencyBloc is a purpose-built solution to address the unique requirements of health and life insurance agencies, standing as the top recommended insurance agency management tool with an integrated CRM system.

The software is enriched with features specifically tailored for the insurance industry, including a tool to compute commissions.

Noteworthy functionalities of AgencyBloc include:

- Comprehensive contact management

- Tool for commission calculation

- Document administration

- Management of insurance policies (assistance in creating quotes, issuing policies, managing renewals, etc.)

- Analytics dashboard

- Automation of marketing tasks

- Ideal CRM solution for: Agencies operating in the life and health insurance sectors.

Pricing: Subscription plans commence at $65/month. Additionally, AgencyBloc offers a free trial period.

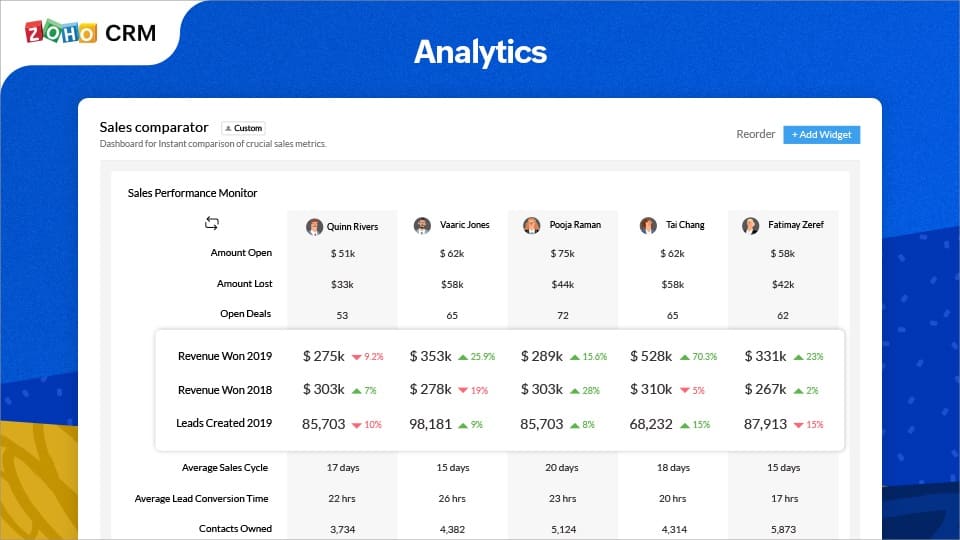

3. Zoho CRM

Zoho CRM is a versatile software system tailored to fit the needs of multiple industries, inclusive of insurance. Insurance agents utilize it for building and maintaining client relationships, fostering lead generation, and automating workflows for optimal efficiency.

The CRM tool offered by Zoho facilitates interaction with policyholders through an array of channels, such as email, telecommunication, live chat, and social media.

Prominent Zoho CRM functionalities include:

- Intuitive user interface

- Management of contacts and leads

- AI-powered insurance sales assistant

- Mobile application

- Omnichannel communication (comprising email, live chat, calls, social media, webinars, etc.)

- Optimal CRM solution for: Multichannel communication

Pricing: Subscription plans kick-off at $14/month when paid annually. Zoho also offers a flexible trial period free of charge.

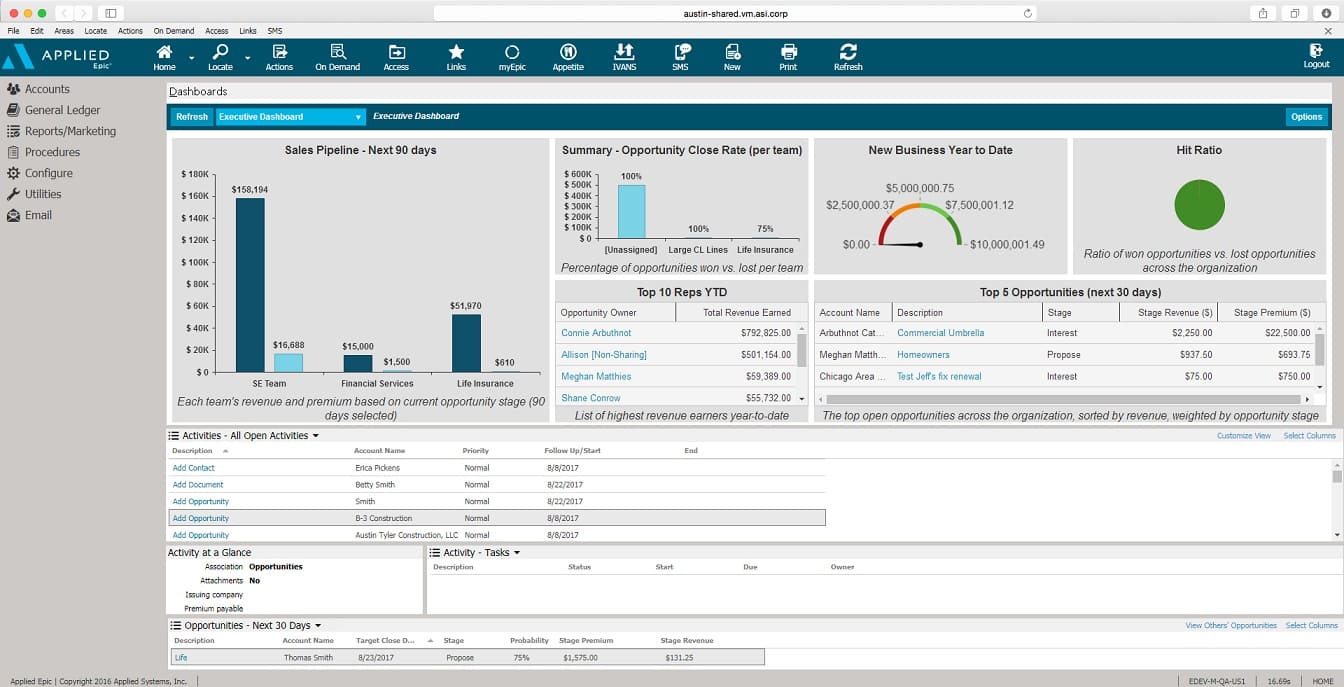

4. Applied Epic

The Applied Epic software equips insurance brokers with the capability to oversee all their client relations and operational processes from a single platform.

Brokers can administer both property and casualty benefits (acquiring quotes, issuing policies, etc.) utilizing Applied Epic. The software also facilitates seamless connectivity to all insurance providers via the IVANS Exchange.

Significant Applied Epic functionalities include:

- Management of Property & Casualty benefits

- Commissions calculation and accounting

- Automation of sales

- Omnichannel customer support

- Single sign-on for IVANS Exchange

- Ideal CRM solution for: Independent agents.

Pricing: For detailed pricing, please contact Applied Epic directly.

5. Freshworks

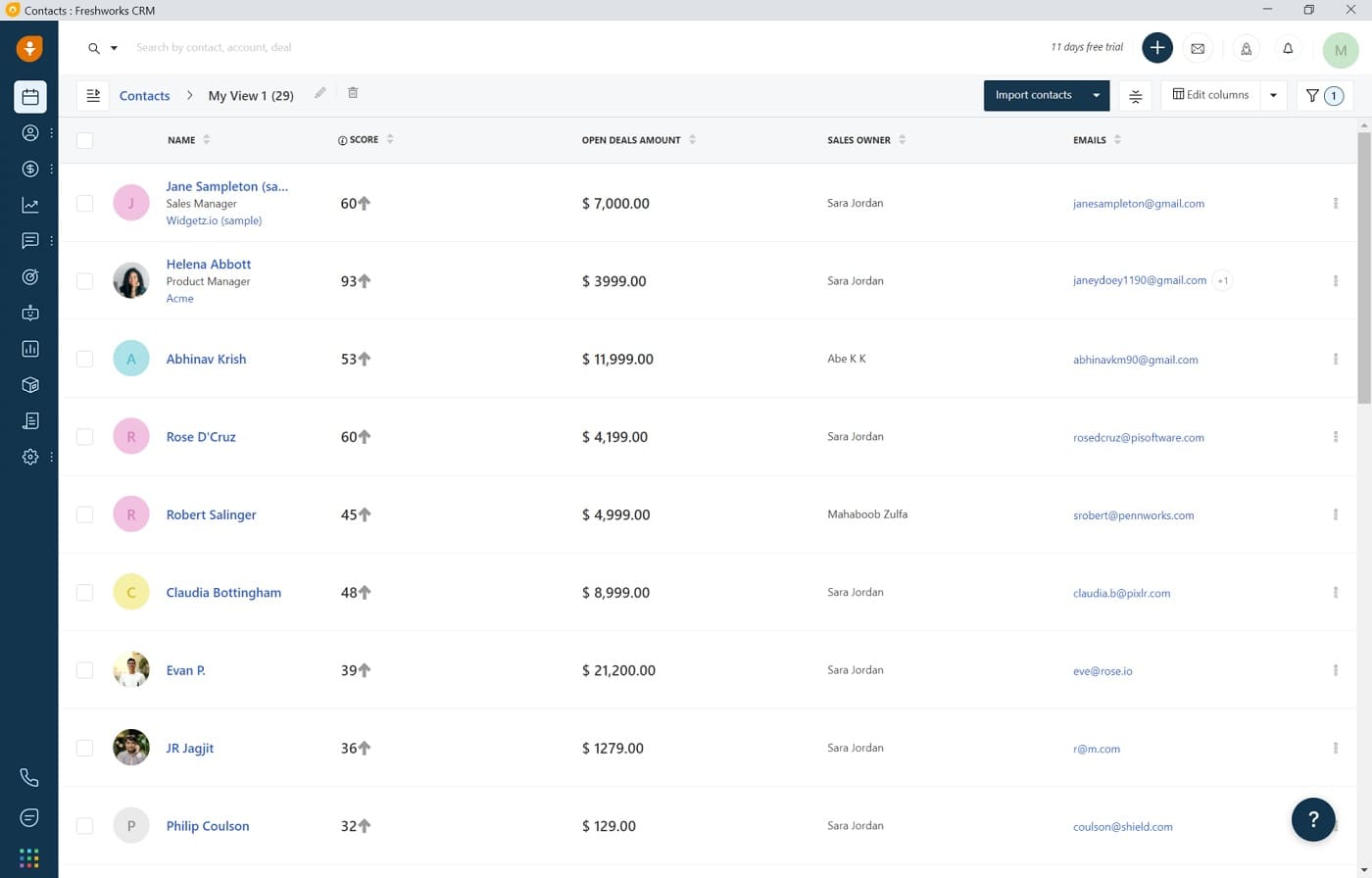

Freshworks CRM delivers a platform specifically tailored for the needs of insurance agents. The software is designed to enhance productivity and foster a relationship-centric business model. It aids agents in automating and streamlining tasks such as documentation and meeting arrangement, thereby allowing them more time to engage meaningfully with their clients.

Interestingly, Freshworks also offers a “Free Forever” plan that does not restrict the number of users that can be added.

Highlighted Freshworks CRM functionalities include:

- Lead scoring and visual representation of the sales pipeline

- Automated sales reporting

- Sales campaigns

- Event tracking

- Real-time chat integration

- Customer support portal

- Perfect CRM solution for: Insurance agents seeking a cost-free CRM platform.

Pricing: The “Free Forever” plan is available. Premium plans begin at $29/user/month when billed on an annual basis.

The selection of an appropriate CRM system hinges on various determinants like the scale of your business and the assortment of products you offer.

Insurance agencies might profit from deploying the CRM provided within their agency management system. Conversely, single agents, insurance brokers, and small enterprises might discover that CRM software customized for insurance brings them the utmost benefit.

Regardless, undertaking thorough research to identify the tools that optimally bolster your business expansion is imperative.